India’s travel and tourism segment is on an exciting ascent. Rising disposable incomes, a growing middle class, and government-led infrastructure initiatives are fuelling a surge in domestic and international travel. This dynamic environment presents an investment opportunity.

Introducing Tata Nifty India Tourism Index Fund your chance to aim high with India's tourism! So, Jet Set Go and be part of this exciting journey.

Why Invest in Indian Tourism Segment?

Growing disposable income and a thriving middle class.

Government initiatives for improved infrastructure and increased travel route capacity.

Rising domestic demand and changing consumer behaviour of eating out more.

Shift towards experiential travel and unique destinations.

Why Tata Nifty India Tourism Index Fund?

Own a Piece of Leading

Tourism Companies

Gain exposure to a diversified pool of companies across tourism segment that are positioned to potentially benefit from the tourism boom.

Track the Market Pulse

The fund aims to replicate the Nifty India Tourism Index, a

benchmark that reflects the tourism segment's performance.

Long-Term Growth Potential

Aim to capture the long-term growth story of Indian tourism

with a single mutual fund scheme.

Who Should Invest?

Long-Term Growth Seekers

Investors with a long-term investment horizon who believe in the growth potential of the Indian tourism segment.

Risk-Tolerant Investors

Suitable for investors with very high-risk appetite, willing

to invest in segment-specific funds.

Focused Investors

Individuals seeking focused exposure to the tourism segment,

but not looking for broad diversification.

Why an Index Fund?

Simple and Cost Effective

Index funds aim to offer a hassle-free and cost-effective investment in a specific segment.

Transparency

The fund holdings are based on a well-defined index, ensuring clear visibility.

Lower costs

Typically, index funds have lower expense ratio as they are passively managed.

About Nifty India Tourism Index

The Nifty India Tourism Index, launched by NSE indices, tracks the performance of tourism and travel segment stocks within the Nifty500. It includes the largest 30 stocks from eligible industries such as hotels & resorts, Airlines, Airport & Airport services, Restaurants, Tour Travel & Related Services, etc. The index offers insights into the segment's performance, provides focused exposure to the tourism segment, and helps in diversifying the investment portfolio. It's a specialized benchmark for assessing the tourism segment's performance in the stock market.

Scheme Details

| Scheme Name | Tata Nifty India Tourism Index Fund |

|---|---|

| Investment Objective |

The investment objective of the scheme is to provide

returns, before expenses, that commensurate with the

performance of Nifty India Tourism Index (TRI), subject to

tracking error. However, there is no assurance or guarantee that the investment objective of the scheme will be achieved. The scheme does not assure or guarantee any returns. |

| Type of Scheme | An open-ended scheme replicating / tracking Nifty India Tourism Index (TRI). |

| Fund Manager | Kapil Menon |

| Benchmark | Nifty India Tourism Index (TRI) |

| Min. Investment amount | Rs. 5,000/- And in Multiple of Re.1/- Thereafter |

Load Structure

| Entry Load | Not Applicable (Pursuant to provision no. 10.4.1.a of SEBI Master Circular on Mutual Fund dated May 19, 2023, no entry load will be charged by the Scheme to the investor) |

|---|---|

| Exit Load | 0.25% of the applicable NAV, if redeemed on or before 15 days from the date of allotment. |

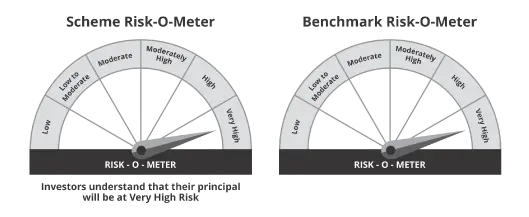

This product is suitable for investors who are seeking*:

- Long Term Capital Appreciation.

- Investment in equity and equity related instruments comprised in Nifty India Tourism Index (TRI)

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

It may be noted that risk-o-meter specified above is based on internal assessment. The same shall be updated as per provision no. 17.4.1.i of SEBI Master Circular on Mutual Fund dated 27.06.2024, on Product labelling in mutual fund schemes on ongoing basis.